Managing your JTEX account is important. But the rules are different than what you have used with cash. Since JTEX will concentrate on finding you buyers for you to earn trade dollars, concentrate on how you spend. Once you are able to put these Best Practices into place, you’ll find that Barter is a great business strategy that will help grow your business and bottom line.

Best Practice #1 – Don’t let your balance get too high! This is not a bank account. You only want as many trade dollars as you can spend. For example: if you spend T$750 per month (T$9,000 annually) you don’t need T$20,000 in your account. If your trade account accumulates too fast, contact the JTEX office to find ways to spend your trade dollars wisely. They have a Business Spending Plan that can help identify how to best use your trade dollars.

Best Practice #2 – Develop a budget and plan what want to spend your trade dollars on. (Use the Business Spending Plan). Be creative, flexible and plan ahead. Here are several categories available in JTEX or reciprocal exchanges – the cash savings can add up fast!

Best Practice #2 – Develop a budget and plan what want to spend your trade dollars on. (Use the Business Spending Plan). Be creative, flexible and plan ahead. Here are several categories available in JTEX or reciprocal exchanges – the cash savings can add up fast!

Advertising – (online, direct mail, billboards, promotional items, video production, TV commercial production, local newspapers, and more)

Printing – (business cards, flyers, brochures, menus, and much more)

Health Care – (dental, medical, chiropractor, weight loss, Fitness Centers, optical, for yourself, family and employees)

Vehicle Maintenance – (repairs, oil change, state tags, wash)

Professional Services – (accountants, lawyers)

Travel – (New Orleans Hotels and Bed and Breakfasts, Beach Condo, Fish Camps, and timeshares)

Restaurants – (for business or pleasure – over 140 available in South Louisiana)

Best Practice #3 – Make a long term commitment (12 months) so JTEX and member businesses can work with you and you are committed to their service or products on trade. Pre-Plan your vacations plan your advertising, develop a marketing budget.

Best Practice #4 – Change the businesses you do business with if you can get the same product or services on trade. Just think of the cash savings you can make when you switch. Give the businesses you currently work with the opportunity to join JTEX before you switch.

Best Practice #4 – Change the businesses you do business with if you can get the same product or services on trade. Just think of the cash savings you can make when you switch. Give the businesses you currently work with the opportunity to join JTEX before you switch.

Best Practice #5 – Be flexible – Don’t get hung up if the price is retail, don’t expect to get the cash discount on trade or for the business to be the cheapest price available – one of the advantages of trade is that you do not have to discount (but some businesses will!) And be flexible if the member business needs to work you into their schedule if you can help it.

Best Practice # 6 Preplan – The more advance notice and time you give other traders the better.

Best Practice # 7 – Take it when it’s there. If you see something good, or want, buy it before the next guy does – grab it first. The best stuff (whether it is a product or a service) moves quickly. Don’t risk letting it get away or having the businesses go on stand-by.

Best Practice #8 – Always check the directory before you go –

Best Practice #8 – Always check the directory before you go –

Each businesses works with JTEX to make sure that they are able to use their trade dollars and don’t accumulate an unhealthy balance – this means that they can go on stand-by at any time or be on a wait-list basis – If the business is in a different trade group – check the directory to make sure they are reciprocal. (Not every business in other trade groups is available for trade)Don’t put yourself or the member business, in a difficult position by trying to trade when they are on hold or are not reciprocal. Just take the time to check the directory online before you attempt to do business!

Best Practice # 9 – Enjoy the barter system and spread the good news!! Tell everyone you know and help JTEX grow. You will reap the benefits as more members join and trade with you.

Most members of JTEX (other exchanges too) who complain about not being able to spend Trade Dollars, have not followed the above practices. If you can’t spend your trade dollars… give them to us, we will!!!! (Just kidding)

*** If you are interested in creating a Business Spending Plan – contact the JTEX offices to schedule an appointment

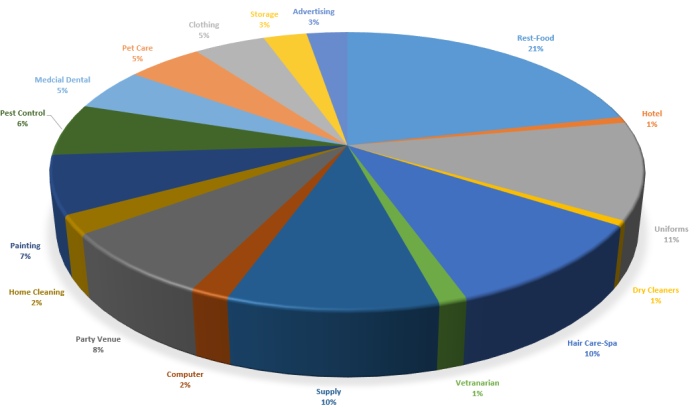

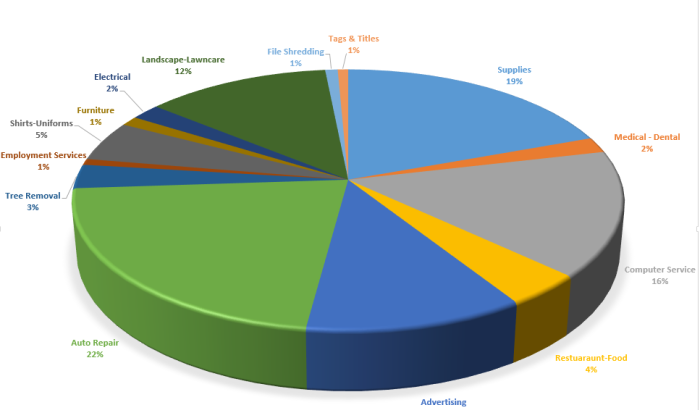

How Top Traders Spend

How Top Traders Spend

For many small businesses struggling with low demand and slow cash flow in the wake of the a tough economy, an age old idea could drive new business: barter. The 200 plus members of Jambalaya Trade Exchange can conserve cash and expand reach by selling their products and services on its exchange for trade dollars accepted by fellow members, says Tim Bergstresser Executive Director of Jambalaya Trade Exchange (JTEX). JTEX was established in 2012 in Ascension Parish, LA ., and is an independent trade exchange that is a part of the Trade Authority network of trade exchanges. Local exchanges are now in 13 cities through the southeast region of the USA. Trade Authority facilitated over $20 million in business-to-business trades last year and it’s member exchanges have over 3200 members..

For many small businesses struggling with low demand and slow cash flow in the wake of the a tough economy, an age old idea could drive new business: barter. The 200 plus members of Jambalaya Trade Exchange can conserve cash and expand reach by selling their products and services on its exchange for trade dollars accepted by fellow members, says Tim Bergstresser Executive Director of Jambalaya Trade Exchange (JTEX). JTEX was established in 2012 in Ascension Parish, LA ., and is an independent trade exchange that is a part of the Trade Authority network of trade exchanges. Local exchanges are now in 13 cities through the southeast region of the USA. Trade Authority facilitated over $20 million in business-to-business trades last year and it’s member exchanges have over 3200 members..